Under the “dual carbon” background, both domestic and international multinational companies are increasingly focusing on ESG development. Nowadays ESG is considered as an essential part of a company’s strategy.

Many Corporate executives recognize the importance of ESG strategies in enhancing competitiveness, reducing risks, and ensuring long-term stability. According to the “Deloitte 2023 Chief Executive Sustainability Development Report”

– Chinese executives prioritize addressing climate change more than the global average. In 2023, 55% of Chinese executives highlighted it as a primary concern, compared to the global average of 42%.

– In 2022, 87% of Chinese companies increased investments in sustainable development, surpassing the global average of 75%.

As we embark on the green path of ESG, let’s explore together the five key ESG trends for 2024.

Keyword One: Anti-Greenwashing

The ESG heat is growing, but it has also brought chaos and controversies. To tackle false “greenwashing”, the organizations are implementing policies to combat deceptive practices.

The European Union has introduced mandatory disclosure requirements for companies and financial institutions to promote sustainability. In China, regulatory authorities are focusing on enhancing ESG information disclosure for companies.

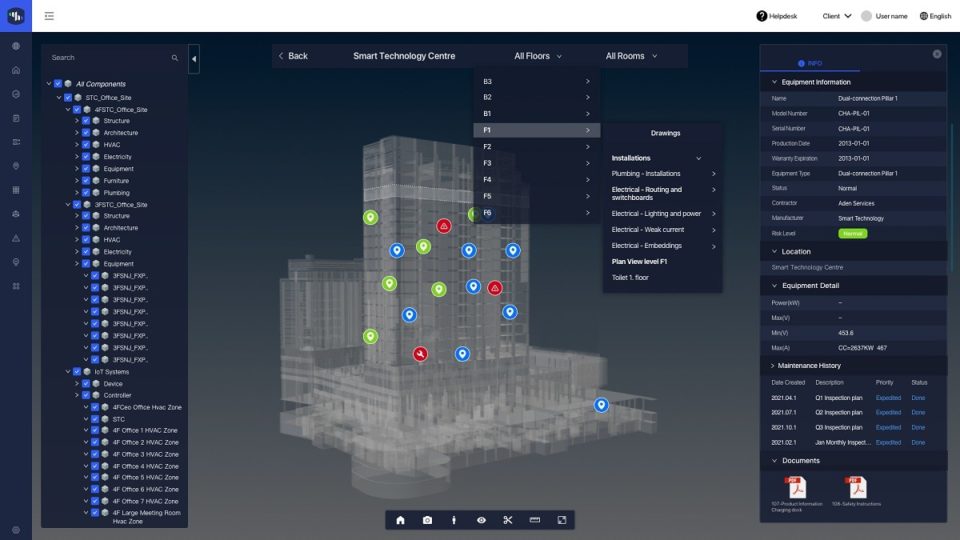

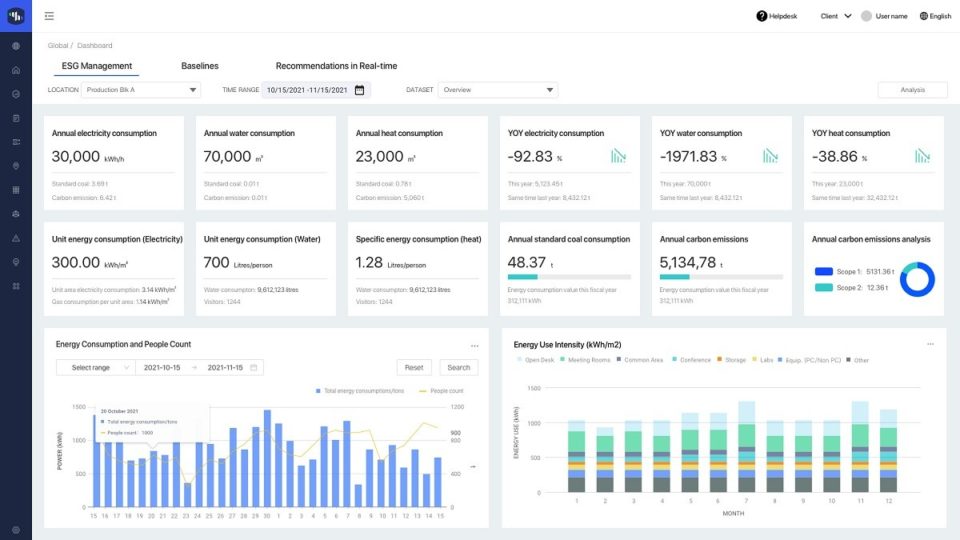

Aden has introduced the Akila digital twin platform to help companies comply with ESG policies. The platform, initially focused on ESG, uses artificial intelligence to monitor and collect real-time energy consumption data from buildings. It integrates this data into a single platform, providing transparent and visual ESG information for corporate managers. This simplifies and accelerates ESG development and ensures compliance with sustainability regulations.

Keyword Two: Digital Twin

Research shows that using digital decarbonization technology alone can reduce carbon emissions by up to 38%, leading to significant improvements in carbon intensity measures. Therefore, incorporating digitization is vital in planning for decarbonization.

Implementing digitization and intelligent upgrades in the construction industry is still feasible. While real-time data monitoring is not new, the challenge lies in connecting and integrating energy consumption data from different platforms. Moreover, many older buildings lack a focus on collecting energy data, making it a priority for managers to unify equipment data.

By integrating various energy consumption data and combining it with operational information, visualizing it on a single interface becomes easier for managers. This allows them to identify issues and understand trends more effectively, aligning with the core concept of intelligent building management – the digital twin.

Aden’s Akila platform revolutionizes intelligent decarbonization management by combining real-time data and digital twin technology. It offers comprehensive ESG solutions, providing in-depth insights and recommendations for enterprises. This platform helps achieve more efficient and compliant operations in energy consumption, carbon footprint, and sustainability.

Keyword Three: “Smart” Industrial Parks

The manufacturing industry is an important driver of China’s economic growth but also a major contributor to carbon emissions. In 2020, global carbon emissions reached 35 billion tons, with industrial manufacturing accounting for nearly a quarter, making it as the second-largest source after electricity, according to the International Energy Agency (IEA).

Given his, China’s traditional manufacturing industry must undergo a low-carbon transformation and prioritize ESG development. These challenges also present new opportunities. To help companies adapt to new policies, achieve ESG goals, and enhance their competitive edge, Aden Group’s industrial new infrastructure brand, NXpark, has emerged.

NXpark aims to assist manufacturing enterprises in creating smarter, more environmentally friendly, and human-centered industrial infrastructure. It focuses on designing buildings that can withstand extreme climate conditions, ensuring rapid delivery, and providing a financially convenient and flexible asset leasing model. Compared to traditional industrial infrastructure, the emphasis of new infrastructure is on technology, environmental friendliness, innovation, and empowerment.

Keyword Four: Energy Efficiency

The majority of people spend about 90% of their time indoors in cities. Around 40% of total carbon dioxide emissions come from buildings, mainly from technical assets like refrigerators, boilers, compressors, and HVAC systems.

Technical assets are important for both the environmental impact of buildings and the overall cost for building owners. One effective way to decrease a building’s carbon footprint is to ensure that all facilities, equipment, and structures are properly maintained and operate efficiently.

Aden’s Technical Asset Management (TAM) department offers comprehensive facility service solutions using digital technology to track and monitor the lifecycle and maintenance process of on-site facilities. It uses predictive maintenance for critical assets and optimizes their efficiency, helping buildings perform well and reduce their carbon footprint even over time.

Aden’s TAM services are available for various types of facilities, including factories, warehouses, commercial buildings, hospitals, and schools. It assists in operating, maintaining, and managing on-site equipment, which results in cost reduction, improved efficiency, and support for ESG development.

Keyword Five: Green Finance

By 2024, companies will further incorporate sustainability into their financial foundation. This means considering the sustainability of tangible assets and valuing intangible assets like goodwill. Many organizations are now creating ESG director positions to ensure the integration of ESG issues into operations and financial reporting.

This integration shows that sustainability and financial stability are not opposing goals. It drives the growth of sustainable investment and financing. More investors and financial institutions are paying attention to companies’ sustainability performance and using it to make investment decisions. This, in turn, motivates companies to improve their sustainability efforts to meet ESG standards and investor demands.

In 2024, ESG standards will be widely adopted globally and seen as opportunities rather than constraints for companies. It is believed that companies should actively turn external risks into business opportunities. By adopting sustainable and circular economic models, companies can reduce their impact on the environment and society while working towards long-term common goals.

Aden provides support to companies in their sustainability journey by integrating facilities, data, and resources to enhance productivity, adaptability, and ESG orientation. This helps companies achieve green sustainable development and create a future that is people-centric and beautiful.

Climate resilient facilities

Climate resilient facilities

.png)